Can I bring in investors at different times?Īn important feature of typical convertible debt documents is the ability to conduct multiple closings without significant marginal cost. I’m trying to raise a convertible debt round. The best piece of advice, however, is to not automatically turn away a great investor because you want to do a debt round and they want to do an equity round. We see equity rounds being done faster and more efficiently than ever, but a convertible debt round can still be done faster and more inexpensively. The major benefit of a convertible debt round over an equity financing is speed. See classic pieces by Seth Levine ( “Has convertible debt won? And if it has, is that a good thing?”) and Jon Callahan ( “Why we (still) don’t invest in convertible debt”). Much has been written about the pros and cons of debt vs. Why should I do a convertible debt financing and not an equity financing? As the size of the raise gets larger, investors start to care more about control provisions and precise ownership calculations, which tends to lead them toward requiring priced rounds in which it is more customary to hash out control and ownership details. But a typical range for a healthy initial convertible debt round being done as an initial round of financing for a startup that is eventually likely going to raise venture capital is $500,000 to $2,500,000. At the low end, I’ve seen small “friends and family” rounds in which less than $100k was raised, and I’ve seen rounds over $5,000,000. What is a typical size of a convertible debt financing?Ĭonvertible debt rounds come in all shapes and sizes.

#CONVERTIBLE NOTES VENTURE CAPITAL SOFTWARE#

Many law firms (including Cooley) have also licensed software to track cap tables (including promissory notes), and there are third party providers such as Carta that will do it as well.

#CONVERTIBLE NOTES VENTURE CAPITAL SERIES#

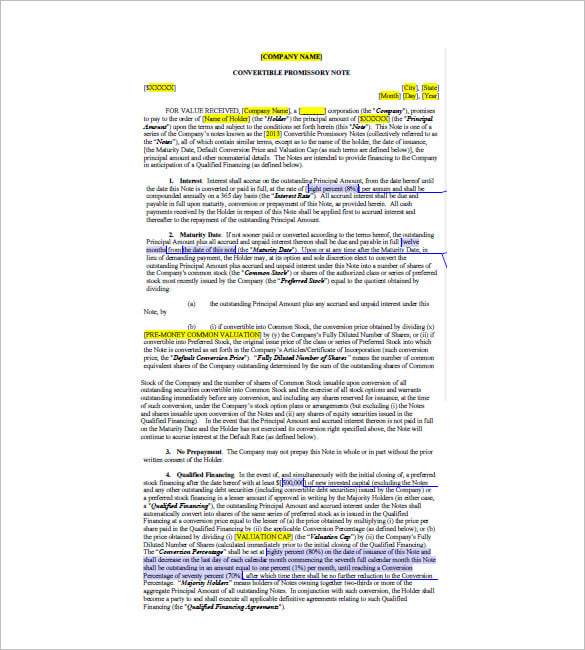

Keep your cap table on one tab and your notes ledger on the next tab – so that when it comes time to compile your Series A cap table (download our Sample Pro-forma Cap Table), which will reflect the conversion of your notes into equity, you have all of the information in one workbook. I would recommend that you keep the ledger in Excel so that you can easily calculate accrued interest. You should keep a ledger of issued notes (listing the holder of each note, the principal amount and the date of issuance). How do I show convertible debt on my cap table?īecause in most cases you won’t know how many shares your convertible debt will convert into, most companies don’t include convertible debt on their cap table. You can also generate your own Convertible Note Documents on Cooley GO Docs.

0 kommentar(er)

0 kommentar(er)